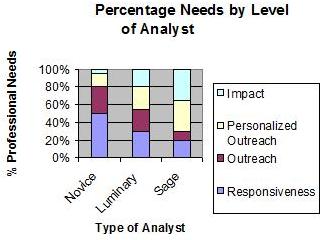

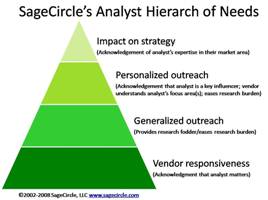

The SageCircle Hierarchy of Analyst Needs provides interesting insights into the professional and emotional needs of analysts (see Part one). What makes this model powerful is the application of the Hierarchy to specific relationships. In the graphic to the right we illustrate that the level of analyst (see Know your analyst – Novice, Luminary or Sage) can have a dramatic impact on their relative needs relative to the level of the pyramid of needs (see below).

The SageCircle Hierarchy of Analyst Needs provides interesting insights into the professional and emotional needs of analysts (see Part one). What makes this model powerful is the application of the Hierarchy to specific relationships. In the graphic to the right we illustrate that the level of analyst (see Know your analyst – Novice, Luminary or Sage) can have a dramatic impact on their relative needs relative to the level of the pyramid of needs (see below).

The novice analyst typically is trying to get up-to-speed on his or her market coverage that encompasses a number of vendors. The novice usually has many questions, both basic and advanced, that they are desperately trying to get answered. As a consequence, their need for responsiveness and basic outreach is disproportionately larger than their need for personalized outreach or making an impact.

Contrast the novice’s needs profile with that of a sage analyst. The sage already has a broad and deep knowledge of the market and participating vendors from a variety of sources. For the sage analyst a generic presentation of information that they already know borders on criminal waste of time. What they want is only information that updates their personal database on those topics in which they are interested. As a result personalized outreach is critically important for developing strong relationships with sages. But responsiveness cannot be allowed to slip. When a sage requests information, timely, focused responses are required. Furthermore, sages typically interact with many senior executives, from both vendor and end user organizations. Thus, sages expect to be brought in to help vendors with their strategy in a mutual sharing of insight and advanced information. For  the sage, the needs profile is heavily weighted toward the top of the pyramid with very little tolerance for generic outreach.

the sage, the needs profile is heavily weighted toward the top of the pyramid with very little tolerance for generic outreach.

This type of analysis should be performed with each analyst tier of your analyst list. Remember you can have any of these analyst types in each of your tiers. The impact of the analyst on your revenues, not their experience, determines the level of effort you give them. However, even level of effort can be somewhat personalized. For example, in our study of the analysts for a major IT vendor with a well-established and effective AR program, the Tier 3 analysts were very satisfied with their treatment even though they were getting almost zero personal attention from AR and zero access to executives. Their satisfaction was based on the excellent outreach the IT vendor does through multiple targeted e-mails and a best-in-class analyst portal. The self-aware Tier 3 analysts realized their status and thus were very pleased with the information they were getting via newsletters and on-line databases.

SageCircle Technique:

- Regularly review and update your analyst ranking and tiering

- Review your Tier 1 analysts to map them against the stages of professional growth

- Analyze your past interactions with each analyst to ensure that the distribution is appropriately targeted to the level of the Needs pyramid and their professional stage

- Modify your AR plan so that each analyst is now receiving the appropriate distribution of interactions

- Use the Hierarchy to educate managers and executives about how the analysts work and why certain AR activities and investments are necessary

Bottom Line: The SageCircle Hierarchy of Analyst Needs can be a good tool for helping set AR priorities. A key insight of the Hierarchy is that one size does not fit all, driving AR groups to start personalizing their interactions with important analysts.

Question: AR teams – Do you track the professional grow stage of your analysts and then cross-reference that against the Analyst Hierarchy of Needs?

Do you want to apply the Analyst Hierarchy of Needs? SageCircle can help – Our strategists can:

- Review your analyst list(s) to determine how the analysts are distributed over the pyramid

- Analyze your analyst interactions to identify skewing toward one level or another of the pyramid

- Critique your AR plan and suggest changes in order to have the greatest impact on the most important analysts

SageCircle strategists understand your opportunities, challenges and priorities because we have been AR practitioners and executives as well as industry analysts and AR researchers. SageCircle emphasizes the use of phone-based inquiry through its Advisory Service, which is your lifeline when you need timely access to an AR and analyst expert to exploit an opportunity or mitigate a problem. Advisory is available through an annual “all you can eat” contract or blocks of two or five hours “by the drink.” Click here to learn more about our advisory services.

To learn more contact us at info [at] sagecircle dot com or 650-274-8309.

[…] point to be aware of when applying the Hierarchy of Needs to your analyst email distribution is emphasis changes depending on the analyst’s status. A Sage analyst will be significantly less tolerant of generic emails than a Novice analyst, who […]